Mining News

Mining News

09 May, 2024

Both total recordable injury frequency rate (TRIFR) and shipments improved for Fortescue during the March quarter, with the major achieving a record shipment month in March. The TRIFR for metals saw a 17 per cent improvement from December 2023 at 1.5. This was compared to a TRIFR of 1.8 at 31 December 2023. While iron ore shipments were six per cent lower at 43.3 million tonnes, shipments did recover during the quarter, with a record month for shipments of 18.7 million tonnes achieved in March. “The Fortescue team pulled together to successfully implement our recovery plan, and we had a record month for shipments in March contributing to 43.3 million tonnes for the quarter,” Fortescue Metals chief executive officer Dino Otranto said . “We also set a new record for railed tonnes, all while continuing to improve our safety performance. “Our decarbonisation plan is progressing well, with our first operational electric excavator moving over one million tonnes of material since being commissioned. Our battery electric haul truck prototype has completed its first phase of testing, exceeding the performance expectations of the battery power system.” The March quarter saw Fortescue successfully conduct the first use of ammonia as a marine fuel onboard the Singapore-flagged ammonia-powered vessel, the Fortescue Green Pioneer. “In true Fortescue style, we are rapidly advancing these opportunities while retaining an unwavering focus on costs and capital discipline,” Fortescue Energy chief executive officer Mark Hutchinson said. “The Energy business achieved several milestones, including the official opening of our Gladstone Electrolyser Facility in Queensland, which positions Fortescue as a large scale producer of electrolyser stacks.” Source: https://www.australianmining.com.au/safety-and-shipments-winners-for-fortescue/

09 May, 2024

Andromeda Metals has finalised the divestment of its 25 per cent stake in the Wudinna gold project in Gawler Craton , South Australia. Wudinna is now wholly owned by Cobra Resources, a gold explorer trading on the London Stock Exchange. For the stake, Cobra paid Andromeda $500,000 in cash and $1 million in Cobra shares. “Andromeda confirms that the sale and purchase has completed and Andromeda’s wholly owned subsidiary Peninsula Resources received $500,000 in cash, in addition to the 52,010,000 Cobra shares that were issued in advance of completion,” Andromeda said . Andromeda announced the Wudinna divestment in November 2023. Andromeda managing director and chief executive officer Bob Katsiouleris said the divestment is consistent with Andromeda’s strategy to divest non-core assets to support the commercialisation and development of the Great White project. “This announcement, in addition to the recent announcement on the sale of Drummond epithermal gold project, demonstrates our strategic focus remains squarely focused on securing the funding required to support a final investment decision for the Great White project being made, and the commencement of construction,” Katsiouleris said in November. For the Drummond project in Queensland, Andromeda allotted 29.5 million shares in Trigg Minerals in exchange for the reimbursement of expenses related to the sale of the project. The shares were issued alongside an upfront payment of $27,000 in cash and a cash refund of $7500 in respect of the environmental bonds for the project. Source: https://www.australianmining.com.au/andromeda-completes-wudinna-divestment/

08 May, 2024

As the two gold miners ready for their merger in June, a strong March quarter has seen these individual entities off with a bang. Red 5 Red 5 has been on a winning streak with its gold production, with the March quarter marking the fourth consecutive quarter over 50,000 ounces. The gold miner produced a total of 50,132 ounces in the quarter, positioning it to deliver at the top end of its 2023–24 financial year (FY24) production guidance of 195,000–215,000 ounces. “The March quarter marked another solid period of consistent delivery by the Red 5 team and our fourth successive quarter of production above 50,000 ounces,” Red 5 managing director Mark Williams said . “All three of our mines – KOTH open pit, KOTH underground and Darlot underground – continued to perform well, delivering the required tonnes and grade. “KOTH open pit had a standout quarter, with a total of 1.8 million tonnes of ore being mined at an overall grade of 0.81 grams per tonne.” KOTH, or King of the Hills, gold mine in Western Australia, saw ore production from a number of areas and contributed to Red 5’s quarterly gold sales of 49,726 ounces. “During the quarter, the major corporate development for Red 5 was the proposed merger between Red 5 and Silver Lake, to create a diversified, leading mid-tier gold company with a very strong balance sheet,” Williams said. “This transaction is a logical combination of two leading mid-tier gold companies, and represents an exciting inflection point for Red 5 shareholders following the successful development, ramp-up and achievement of steady-state production at King of the Hills.” Silver Lake Quarterly production HIT 64,967 ounces of gold and 349 tonnes of copper for Silver Lake, with ongoing drilling at the miner’s Western Australian operations to advance potential new mining fronts to increase operational flexibility and life of mine. The strong year to date performance has Silver Lake well positioned to exit FY24 having delivered or exceeded group sales guidance for the 10th consecutive year. “During the quarter Silver Lake again delivered strong operating performance and continued the established track record of strong free cash generation in Western Australia,” the miner said. “Importantly, the strong free cash flow result is in parallel with the continued investment in growth and mine life extension opportunities with the ramp up of activities at the Santa mining complex (in WA) through the quarter culminating in the first blast on April 8 and the ongoing 93,000 metre drill program at the Sugar Zone.” The commencement of mining at Santa reestablishes open pit mining at Mount Belches for the first time since 2016. Cash and bullion sat at $342 million at the end of the quarter. Source: https://www.australianmining.com.au/march-quarter-a-winner-for-red-5-silver-lake/

08 May, 2024

Lynas Rare Earths made strong progress across its growth projects during the March 2024 quarter amid lower rare earths prices. “Sales revenue and sales receipts for the quarter, at $101.2 million and $107.7 million respectively, reflected the low average NdPr price during the quarter and also our decision to hold both NdPr (neodymium–praseodymium) and SEG (mixed heavy rare earths) inventory rather than sell into the low price environment,” Lynas chief executive officer Amanda Lacaze said . Despite the low rare earths prices, Lynas achieved “excellent” production rates, with 1724 tonnes of NdPr produced during the period. Construction activities at the Mount Weld expansion project also progressed well, with structural, mechanical, piping (SMP) and electrical works on Stage 1 (concentrate dewatering) being well advanced. “The energisation and commissioning of the Stage 1 circuit will commence over the next few months, and the Stage 1 circuit will initially be tied into the existing operation,” Lacaze said. “A staged commissioning approach reduces commissioning risk and enables a step-up in production capacity in the latter part of this calendar year whilst the remainder of the plant is constructed.” Construction of Mount Weld’s Stage 2 (balance of plan) is also ramping up with all long lead equipment such as grinding mills and flotation cells on site. Concrete works at Stage 2 are also advancing and SMP works are set to commence in late April. Following the first feed of material from Mount Weld into the Kalgoorlie facility in December 2023, Lynas continued to carry out final commissioning and initial production activities at the Kalgoorlie project. These activities remain ongoing. “Introduction of concentrate into the process has informed additional works and activities,” Lacaze said. “This has included enhanced electrical back-up systems following the major electricity outage in late January, further testing of loading and unloading systems and additional testing of the flowsheet. “Based on the continued finalisation of construction costs and the extended commissioning timeline, the updated project budget for the Kalgoorlie facility is estimated at a capital cost of approximately $800 million, an increase on the previous estimate of $730 million outlined in August 2023.” After awarding Western Australian company Carey Group Holdings a five-year mining services contract in March, Carey commenced work at Mount Weld in April. “The contract will draw on Carey’s nearly 30 years of experience as an open pit mining contractor and leading 100 per cent First Nations-owned business, including as a service provider to neighbouring mines near Laverton,” Lacaze said. Last week, mining magnate Gina Rinehart snapped up a 5.82 per cent stake in Lynas amid her rare earths spending spree . Source: https://www.australianmining.com.au/lynas-powers-through-low-rare-earths-prices/

08 May, 2024

For most of us, when we think about mining and the environment, it tends to be about water and air pollution, disasters such as the fatal collapse of tailings dams, or the global warming consequences of coal mining. But the extraction of metals such as copper, nickel and cobalt will be increasingly important as we urgently seek ways to cut emissions from other building blocks of the global economy such as steel, cement and aluminum. By 2050, the World Bank forecasts that demand for the metals and minerals used to produce the clean energy technologies that will be needed to meet Paris Climate Agreement goals will increase by almost 500%. New mines will bring increased risks to nature and biodiversity. Conservation group Re:wild warned recently, for example, that more than a third of Africa’s great apes are at risk because of the surge in demand for the minerals that are vital for green technologies. At the same time, the sector is itself becoming more vulnerable to the impacts of climate change, including increased flooding, heatwaves, drought and increased competition for water. A McKinsey study found that 30%-50% of production for copper, gold, iron ore and zinc is in areas of high water stress, and those figures are predicted to rise. “In Chile, 80% of copper production is already located in extremely high water-stressed and arid areas; by 2040, it will be 100%,” the consultancy says, adding that 40% of Russian iron ore production will suffer from extreme water stress by 2040. Recently, mines from Brazil to Germany have had to shut down temporarily because of water shortages, costing their operators millions of dollars. Reducing the water intensity of mining operations will be crucial to improve the resilience of production assets. Extreme heat and sea level rise are other climate impacts the sector will have to address. The industry also faces pressure to cut its own emissions as businesses across the world increasingly look at the carbon impact of their supply chains. “Although metals are not yet priced on their CO2 footprint, that day could come,” McKinsey points out. Coal, which currently accounts for about half of the global mining market, may be flying high at the moment, but demand, not just from power generation but also from steelmakers and cement producers, will recede as the pressure to decarbonize increases. Many mining companies face having to rebalance their portfolios to replace revenues from coal production. The Global Investor Commission on Mining 2030 was launched in 2023 to address key systemic risks that challenge the mining sector’s ability to meet the demands of the low-carbon transition. As they scale up production of transition minerals, “they must do so responsibly and without harm to communities and the environment – or risk conflict and opposition from host communities that will in turn undermine the global climate transition,” it says. The commission, backed by $13 trillion of assets under management, is chaired by Adam Matthews, who is also chief responsible investment officer of the Church of England Pensions Board. He says the commission’s focus areas include artisanal mining, child labour, the impact of automation and the future workforce, indigenous communities’ and First Nations’ rights, impacts on biodiversity, climate change, tailings dams, conflict reconciliation and corruption. “To meet our climate targets, a lot of mines need to be expanded or developed from scratch in areas with a lot of complex dynamics,” Matthews says. “We need a global focus on what is needed for the transition, and where those assets are located, communities need to benefit.” Energy analysts Wood Mackenzie say the switch to net zero “will require a total rethink of what the mining and metals space is, and where it needs to be”. The industry will have to electrify its operations as much as possible, not just through the use of renewable electricity but also by replacing giant diesel-fuelled trucks with alternatives powered by batteries or fuel cells, or using LNG, hydrogen and e-fuels. There will also be opportunities to improve efficiency through the use of autonomous fleets, while artificial intelligence and machine learning should also streamline operations and identify opportunities to cut emissions. Matthews, however, stresses that mining works on a multi-decadal time frame that often comes up against short-term investor horizons. “A lot of these things take a considerable amount of work, real engagement with communities and challenge business models that focus on shorter time frames than the industry actually works to,” he says. While there are a number of initiatives to help operators to reduce their impacts, these are not always well developed or universally applied. “There is a complex landscape of standards and we need some consolidation,” Matthews points out. “And in some areas, there are no standards. There was no standard for tailings until recently, for example, but one is now being developed.” Schneider Electric’s Materialize platform, which it launched in April with the Global Mining Guidelines group and Glencore, is an initiative that aims to bring mining and minerals groups together to cut emissions in the sector’s global supply chain. “There is a multitude of different players across mining, minerals and metals, of different sizes and with different capabilities to be able to decarbonize,” says Rob Moffitt, president, mining, minerals and metals at Schneider Electric. “Materialize was formed to help those companies create a critical mass across the value chain.” One area where the platform could have a significant effect is in increasing the use of renewable energy. “By combining the purchasing power of different companies, we can accelerate the deployment of clean energy through utility-scale PPAs (power-purchase agreements),” Moffitt says. The platform will also be used to engage thousands of suppliers, share best practice and allow companies to track emissions from suppliers. “There will be far more pressure on the supply of critical minerals in future,” he says. “If we are going to decarbonize, we really need these industries. But we need to work out how to produce these minerals in a more sustainable way.” Source: https://www.mining.com/web/esg-watch-why-climate-change-is-leaving-mining-firms-between-a-rock-and-a-hard-place/

08 May, 2024

A 10-year review of the Western Australian Mining Rehabilitation Fund (MRF) has been undertaken, with stakeholders invited to give feedback. The MRF is a pooled fund that WA tenement holders under the Mining Act 1978 are required to contribute to through an annual levy. If a mine operator is unable to meet their rehabilitation obligations and the site is declared abandoned, the MRF can be used to ensure rehabilitation is carried out. An independent, 10-year review into the operation of the MRF is a requirement of the Mining Rehabilitation Fund Act 2012 (MRF Act). Marsden Jacob Associates was engaged by the WA Government to undertake the public consultation and statutory review of the MRF Act. Overall, the review found the fund continues to function well as a targeted approach to minimising the environmental, social and financial risk of abandoned mines to WA. “The MRF is essential to the state’s capacity to manage and rehabilitate abandoned mines, leading to better environmental and community safety outcomes,” Department of Energy, Mines, Industry Regulation and Safety resource and environmental compliance executive director Tyler Sujdovic said . “It is encouraging to see that stakeholders were generally supportive of the MRF Act, and that its objectives and purpose remain relevant. “There is always, however, room for continuous improvement and the department will review the recommendations within the report and investigate potential actions to improve the effectiveness of the MRF.” Source: https://www.australianmining.com.au/mining-rehabilitation-fund-continues-to-deliver/

08 May, 2024

Chalice Mining has begun steps towards a selective mining campaign at its Gonneville nickel-copper-platinum group element (PGE) project in Western Australia. Recent modelling work has focused on re-interpreting high-grade sulphide zones within the resource at a much more granular level, which the company said will maximise production in the face of weakened prices. “The remodelled high-grade sulphide resource marks the first step in the reset of the development strategy for the Gonneville project,” Chalice managing director and chief executive officer Alex Dorsch said . “The high-grade model provides improved high-grade definition to underpin the design of a more selective, smaller scale starter project.” As part of the updated mineral resource estimate, high-grade palladium, nickel and copper zones have been modelled separately to better define the mineralogical domains. Previous resource models assumed bulk open-pit mining approaches only with significantly larger block sizes. An additional 56 drill holes have also been incorporated, both to increase confidence in the resource as well as extend it down-dip to a depth of around 1100m. “Importantly, a smaller scale starter project design allows for future expansion into a larger scale bulk mining operation, according to prevailing economic conditions at the time,” Dorsch said. “Selective mining initially preserves the optionality of a future expansion, as mined material will be stockpiled for future processing. “This staged development approach reduces risk, allows efficient deployment of capital and maximises optionality.” Source: https://www.australianmining.com.au/chalice-changes-tack-on-gonneville/

08 May, 2024

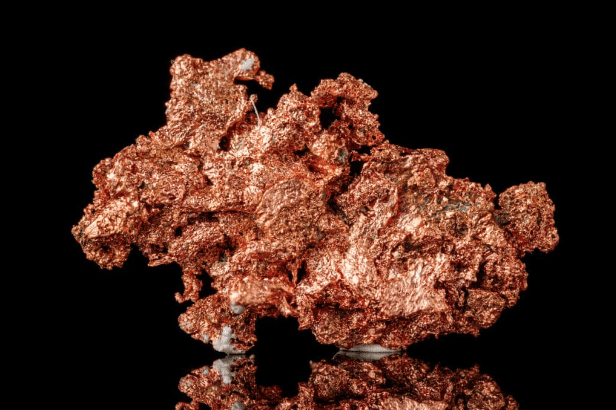

Revolver Resources has continued to make strong progress at its Dianne copper mine with ongoing support from the Queensland Government. Revolver is currently progressing detailed mine planning and scheduling activities, helped along by a maiden $1.3 million grant from the Queensland Critical Minerals and Battery Technology Fund. The mine is on track for targeted first copper cathode production during the second half of 2025. “Revolver is fortunate to be in a very unique position with a high-grade copper ore body at-surface at the Dianne mine,” Revolver managing director Pat Williams said . “We have no existing debt and we have a truly incredible pathway to generating production revenues, to fund the company’s growth and accelerate the scale of our exploration activities across our highly prospective tenure at the broader Dianne and Osprey projects.” Revolver is now undertaking Traditional Owner engagement and broader workforce participation planning, with project debt and equity funding solutions well advanced. “Our Dianne copper mine project, the site of one of the world’s historically high-grade copper mines, is now in the advanced stages of planning for operational recommencement,” Williams said. “While advancing the project towards targeted final investment decision later in 2024 and first production in 2025, we absolutely plan to continue focused copper (and gold) exploration activities in parallel. “This includes targeted further drilling in the Larramore volcanics belt at Dianne and project Osprey during the remainder of 2024.” Source: https://www.australianmining.com.au/queensland-backs-dianne-copper/

08 May, 2024

Gold Road Resources has ended discussions with Orion Resource Partners, a global alternative investment firm, to acquire its 40 per cent stake in the Greenstone Gold Mines. The announcement comes a week after Gold Road responded to media speculation that it would acquire a substantial interest in the operation. Located in Ontario, Canada, the Greenstone Gold Mines are currently held in a joint partnership between Canadian-based Equinox Gold, who owns 60 per cent, and Orion Resource Partners, who holds the balance and is looking to divest its stake. “As previously stated, Gold Road continues to evaluate strategic opportunities as part of a considered and diligent growth strategy,” Gold Road said in an ASX statement on Tuesday. “The company will only pursue these opportunities on terms and at values which it believes are in the best interests of its shareholders.” Orion Resource Partners is reportedly seeking a valuation of more than $1 billion for its Greenstone stake. The Greenstone project has an expected mine life of 15 years, over which it has been tipped to produce over 400,000 ounces of gold per year. Production is anticipated to begin this year. Despite ending its talks with Orion Resource Partners, Gold Road confirmed earlier this week that mining and processing operations at the Gruyere joint venture it shares with Gold Fields have resumed after a period of heavy rainfall. Source: https://www.australianmining.com.au/gold-road-exits-greenstone-talks/

28 Apr, 2024

Martin Engineering, a world leader in bulk handling solutions, is marking the 50th anniversary of its invention of the world’s first low-pressure air cannon. Air cannons have transformed material flows in bulk processing systems, eliminating problematic internal buildups and blockages. After five decades of continuous innovation, Martin Engineering remains at the forefront of air cannon advancements, enabling industrial plants to run more profitably, efficiently and safely than ever. The company launched the world’s first low-pressure pneumatic air cannon – its legendary Big Blaster – in 1974. It was devised and developed by Carl Matson, a member of Martin’s senior team and cousin of the firm’s founder Edwin F. Peterson. The patented technology was designed to dislodge stubborn material stuck to the inside walls of hoppers and silos by firing precisely timed bursts of compressed air to keep bulk material flowing and preventing the growth of serious build-ups and blockages. The air cannon was originally aimed at the same quarrying applications as the legendary Vibrolator, the Martin-patented industrial ball vibrator on which the company’s success had been built since its inception in 1944. By the 1980s, as Martin Engineering expanded its global presence, the Big Blaster was already being reimagined for use in high-temperature industrial applications to maintain the flow of sticky materials through the process and minimise unscheduled downtime. Martin air cannons soon proved to be a game-changer for sectors such as cement, for the first time signalling an end to workers having to access the interior of preheater vessels to manually break off hefty material build-ups using a high pressure water jet – one of the most unpleasant and hazardous jobs on a cement plant. By the 1990s, Martin Engineering had developed an extreme heat and velocity version of the Big Blaster, called the XHV, with an all-metal construction capable of withstanding the harshest of conditions. During the 2000s, Martin became the first to introduce a safer positive-pressure firing valve with its Tornado air cannon – technology that prevents unintentional firing if there’s a drop in system pressure, and also allows solenoid valves to be positioned up to 60m from the air cannon for easier access and maintenance. Designed with safety in mind, the positive firing valve also delivers a more powerful blast. Soon after that came the introduction of the Hurricane valve, located in the rear of the air cannon tank rather than at the tank and nozzle junction, greatly improving safety and ease of maintenance. The exterior-facing design eliminates the need for removal of the tank so maintenance is a simple one-worker operation requiring only minutes for replacement. In 2008, Martin Engineering opened its industry-leading Center for Innovation , which accelerated the company’s air cannon technology advancements including: SMART Series Nozzles with multiple nozzle tips, one of which features a retractable design that extends the 360° nozzle head into the material stream only when firing, protecting it from repeated abrasions and extreme temperatures. Its clever Y-shaped assembly means the nozzle can be installed, accessed and serviced without removing the air cannon or further disruption to the vessel structure and refractory. The Martin Thermo Safety Shield , which acts as a safety barrier to allow timely and safe maintenance of air cannon systems. It protects workers from exposure to severe temperatures so that maintenance can take place safely and production stays on schedule. Martin Engineering’s current ground-breaking air cannon designs are the result of research and development in the Center for Innovation, located at the company’s headquarters in Neponset, Illinois. The centre will open its doors to visitors in the Summer of 2024 as part of the 50th anniversary celebrations. “From the very beginning, our air cannons were specifically designed to produce a quiet but powerful, high-velocity discharge of plant-compressed air to dislodge buildups and enhance material flow,” Martin Engineering global air cannon product manager Brad Pronschinske said. “They were developed to be capable of handling the high temperatures, harsh gases and abrasive, corrosive materials associated with heavy industries, and yet have low maintenance requirements and low costs. Since the launch of the Big Blaster 50 years ago, we have continued to innovate, introducing smarter and ever more powerful air cannon systems that improve efficiency, productivity and safety. “We’re especially proud that Martin air cannons have become so important in reducing the health and safety risks associated with clearing blockages manually – such as working in confined spaces, working at height, falling materials, and working in hot and dusty environments. “Our team is always working on new developments and we’re looking forward to bringing the next generation of air cannon technologies to our customers all over the world.” Source: https://www.australianmining.com.au/martin-engineering-celebrates-50-years-of-air-cannon-technology/

Jobs in Mining Australia does not receive any funding to operate its business. All profits are used to improve the service we offer to Jobseekers.

USEFUL LINKS

FOLLOW US

STAY INFORMED

You need a helping hand with your project?

Thank you for contacting us.

We will get back to you as soon as possible

We will get back to you as soon as possible

Oops, there was an error sending your message.

Please try again later

Please try again later

CONTACT US

Contact Us

Thank you for contacting us.

We will get back to you as soon as possible.

We will get back to you as soon as possible.

Oops, there was an error sending your message.

Please try again later.

Please try again later.

© 2024

All Rights Reserved | Jobs In Mining Australia

Powered with 💛 by Shazamme